"Potential Private Retirement Benefit Information" letter from U.S. Social Security

(Page updated Jan 1, 2026) From the independent association for former employees of HP and HPE -- and those in the process of leaving. Not officially endorsed or supported.

Received a "Potential Private Retirement Benefit" letter from U.S. Social Security? How to decode this confusing letter -- and who to contact, if necessary.

Service at HP predecessor companies.

Of HPInc's many predecessor companies, only HP and DEC ever had US retiree healthcare programs -- setting aside money over the years in dedicated trust funds. Employees of other acquisitions did not get credit under HP's long-service retiree healthcare program for service at the predecessor -- but generally did get service credit for other benefits. Details: https://www.hpalumni.org/health

Of HPInc's many predecessor companies, only HP, DEC, and EDS ever had US pension plans -- setting aside money over the years in dedicated trust funds. Employees of other acquisitions did not get credit under HP's pension programs for service at the predecessor -- but generally did get service credit for other benefits. Details on HP-related pensions: https://www.hpalumni.org/RetirementPlans

EDS alumni report that their original EDS hire date is mentioned in their HR records at HP Inc, HPE, DXC, and Peraton.

How the Social Security letter is generated.

Every year, administrators of retirement plans (such as Fidelity) upload a summary of each participant's transactions to the Employee Benefits Security Administration, the US Department of Labor agency that regulates retirement plans.

When you apply for Social Security benefits, the Social Security Administration searches decades of Department of Labor retirement plan records for your Social Security number -- and may send a cryptic letter. This is a well-meaning, but confusing, effort by Social Security to remind people of possibly-forgotten retirement accounts.

The key word is "potential" -- in most cases, the account mentioned was resolved when you left the employer -- and covered in the documents you received at that time.

Look at the "Year Reported" -- and the "Type of Benefit" and "Payment Frequency" codes given on the front of the letter. Check the codes in the two tables on the back of the letter.

Typical comments from our

members...

"I had rolled over the pension

like 15 years ago!"

"The amount on the

SS statement was way less than what I was paid so I thought

there were additional funds to be had."

However, some alumni have found lost accounts -- especially those who have moved. "I'm all registered and it was easy. Thanks so much!" --Retiree

This page has advice from the independent HP/HPE Alumni Association (which is not officially endorsed or supported) on how to decode and who to contact about your letter -- and how to investigate a retirement benefit plan.

Keep address current on every financial account. Run easy unclaimed property search every year. Employer does not update your address. Neither cashing dividend checks, receiving direct deposits, online access, nor receiving statements prevents inactive accounts from being turned over to the state – only a personally-initiated transaction, postal response, or call. Difficult to retrieve money; stock is sold. Unclaimed Property

(Best official explanation is the Employee

Benefits Security Administration's "FAQs on SSA

Potential Private Retirement Benefit Information"

https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/ssa-potential-private-benefit-information-notice.pdf

)

It was probably resolved when you left. How to decode this confusing letter -- and who to contact

Step 1. Look at the "Year Reported" -- the date of the last report received by the Dept. of Labor about your participation in that plan. (The date shown may be a year after the actual transaction.)

...and at the "Plan Name"

What was going on with your job that year and the previous year?

The report date may be due to a post-acquisition or post-spinoff cleanup. Former Compaq, DEC, and Tandem employees may get reports dated 2002, the year that Compaq was sold to HP. Former EDS employees may get reports dated 2009, the year after EDS was sold to HP.

Step 2. Check the "Type of Benefit" and "Payment Frequency" letter codes against the list on the back of the letter.

Type of Benefit:

A -- A single payment of a lump sum [Per member

reports: you rolled to a different plan, bought an annuity, or took cash.]

B -- Annuity payable over a fixed number of years

C -- Life annuity

D -- Life annuity with period certain

E -- Cash refund life annuity

F -- Modified cash refund life annuity

G -- Joint and last survivor annuity

M -- Other (Type of annuity not reported) [Per member

reports: You left before vesting in that plan.]

Payment Frequency:

A -- Lump Sum [Per member reports: you rolled to a different plan, bought an annuity, or took cash.]

B -- Annually

C -- Semi-Annually

D -- Quarterly

E -- Monthly

M -- Other (Payment frequency not reported) [Per

member reports: You left before vesting in that plan.]

This will correlate with your annual statements from the plan administrator and the documents you received when you left that employer.

If you need information on a given "Plan Name" or "Plan Number" we have details on major HP-related plans: Retirement Plan Index

Who to contact

The "Plan Administrator and Address" is usually invalid -- in use at the time of the filing with the Dept. of Labor. (Hanover Street, Compaq Center, Pruneridge Ave, America Center Drive, Legacy Drive, Forest Lane, Maynard, etc.)

Hewlett-Packard breakup. On Nov 1, 2015, the legal name of the Hewlett-Packard Company was changed to HP Inc. ("hp" logo, HPQ stock symbol) and a new, completely separate company – Hewlett Packard Enterprise (no hyphen, singular, "HPE" logo and stock symbol) – was spun off. Portions of HPE were later spun off into DXC and Micro Focus: HP Breakup

HP Inc is the overall legal successor to Hewlett-Packard and to companies acquired by Hewlett-Packard before Nov 1, 2015 – Compaq, EDS, etc. – regardless of whether a business unit ended up in HPInc or HPE. Unofficial directory of HP/HPE acquisitions For employees of HP -- and predecessor companies -- who left before the HPInc/HPE separation, responsibility for any health or retirement benefits varies from country to country, depending on employee population. For the US, HPInc has responsibility. For Canada and UK, HPE has responsibility. In many countries, plans were split between HP Inc and HPE. See: Where are my benefits?

- US: Pension and 401(k) accounts. Fidelity is the primary administrator. 1-800-457-4015 (If no password, keep hitting #.) (Outside US 1-508-787-9902 collect.) https://nb.fidelity.com (Don't go to a local Fidelity office, which is focused on sales.)

Hewlett Packard Enterprise (HPE) is the overall legal successor to companies acquired by HPE – such as Cray, Juniper, Nimble, etc.

- US: Pension and 401(k) accounts. Fidelity is the primary administrator. 1-800-409-4015 (If no password, keep hitting #.) (Outside US 1-508-787-9902 collect.) https://nb.fidelity.com (Don't go to a local Fidelity office, which is focused on sales.)

If the Plan Name refers to stock in a company that was acquired. Find info on how stock of that company was retired: Other Predecessor Companies

EDS pension. If you were employed by EDS or "EDS, an HP Company" before Jan 1, 2009 -- you may have an EDS pension, which has been merged with an HPInc pension plan: https://www.hpalumni.org/edsPension

Info for those who worked at: Agilent Autonomy Compaq DEC DXC EDS HP HPE Juniper Keysight Micro Focus Perspecta Poly Tandem Other acquisitions and spinoffs

If you aren't sure what happened...

...especially if you

worked for a predecessor company such as Compaq, DEC, EDS, etc. How

to investigate a retirement benefit plan. Topics: Check for lost property. Which company is

currently responsible for the benefit. How to contact the current administrators. Surviving spouse

provisions. Legal postal contact addresses.

https://www.hpalumni.org/RetirementPlans-Investigate

Official explanation...

The U.S. Department of Labor regulates

private pension plans -- and keeps detailed pension records. Here's the

official document explaining the letter -- which also covers other types

of pension plans that are not relevant to HP-related employment:

https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/faqs/ssa-potential-private-benefit-information-notice.pdf

At the end, it says: "Need assistance from a Benefits Advisor? Contact

our Benefits Advisors electronically at

https://www.dol.gov/agencies/ebsa/about-ebsa/ask-aquestion/ask-ebsa

or by calling toll-free 1-866-444-3272."

Examples

Code A.

Money moved out of the specific plan -- rolled the money into a different plan, bought an annuity, or took the cash. ( Click to see this example letter with key points highlighted.)

- Year Reported 2000. "HP INC. 401 K PLAN"

- Type of Benefit "A" -- decoded on the reverse of the letter to mean "A single payment of a lump sum."

The person in this example remembers rolling over their 401(k) when they left HP in 2000, which would have been reported to the Dept. of Labor at that time. [ jpg of front jpg of back ]

Code M

Left employer before plan vested.

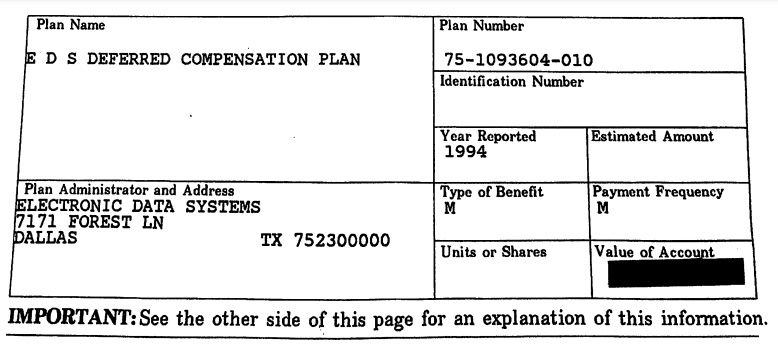

- Year Reported 1994. "E D S Deferred Compensation Plan"

- Type of Benefit "M" -- decoded on the reverse of the letter to mean "Unknown."

- "Plan Administrator and Address" EDS sold the Forest Lane site in 1996, two years after that report to the Dept. of Labor.

The person in this example worked for EDS for only a short time.

Related topics...

Stock. If you were ever an HP shareholder, you may now have shares of HPQ, HPE, Keysight, and/or Agilent – in different accounts. If ever an HPE shareholder, you may now have shares of DXC – and may not have received cash payouts for MFGP and PRSP. Find it all – and estimate your current cost basis: HP/HPE-Related Stocks

Other benefits -- such as Social Security, Medicare, annual enrollment, COBRA, troubleshooting retiree health coverage, etc:. HPAlumni Benefits Menu

Click to join our forums Question? Email us: info@hpalumni.org

Helping each other with life after Hewlett-Packard, HPInc, and HPE. Join independent HP/HPE forums

Independent, member-supported volunteer association. Not officially endorsed or supported. ©2026 Hewlett-Packard Alumni Association, Inc. By using this site you accept these terms.